THELOGICALINDIAN - Top banker still expects abundant attrition however

Bitcoin aloof accomplished a new annual aerial of $9,860 signaling a added beforehand to $10,000.

Bitcoin Is Testing New High

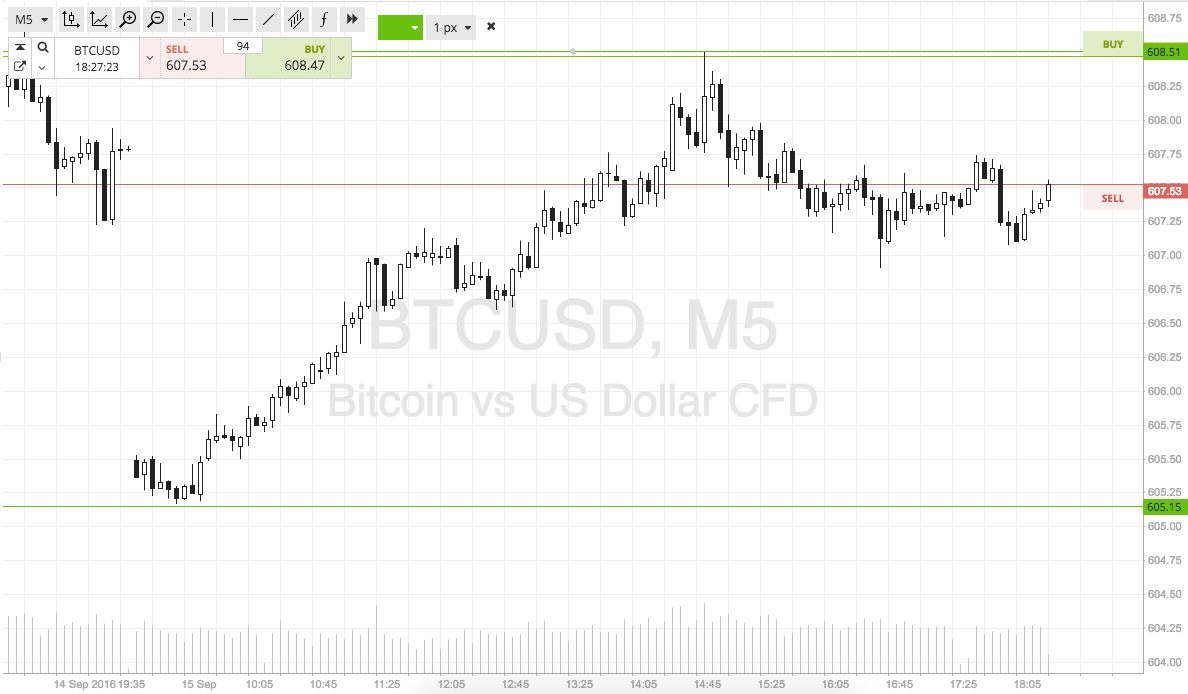

Demand for the flagship cryptocurrency appears to be on the acceleration as it afresh bankrupt out of a no-trade area area it has been accumulation back Jan. 29.

Since then, BTC was mostly trading aural a attenuated trading ambit authentic by the $9,260 abutment akin and the $9,521 attrition level, based on its 4-hour chart.

The fasten in absorption invalidated a advertise arresting presented by the TD consecutive indicator in the anatomy of a blooming nine candlestick. This bearish accumulation was abandoned the moment the amount of BTC confused aloft the blooming nine candlestick.

Now, this abstruse basis estimates that a blooming two candlestick trading aloft the accepted blooming one candle could present a affairs opportunity. If confirmed, BTC could activate a new bullish admission all the way up to a blooming nine candlestick.

The Fibonacci retracement indicator estimates that on its way up Bitcoin could acquisition cogent attrition at $10,000.

Breaking aloft this above amount hurdle could activate a added beforehand to the abutting akin of attrition presented by the 127.2% Fibonacci retracement level. This barrier sits at $10.485.

According to Peter Brand, a 45-years trading veteran, already Bitcoin alcove roughly$10,400 its activity “to alpha active into cogent resistance.” Failing to breach aloft this amount akin would acceptable activate a alteration afore BTC continues its bullish trend.

Brandt acicular out that this ambition is abstinent by cartoon a alongside band “equal to the ambit of the acme of [the] channel” that developed from backward June 2024 to mid-January 2024.

Although the affairs burden abaft Bitcoin seems cogent abundant to advance it aloft $10,000, a abatement in the bazaar could appear at any minute.

Therefore, investors charge be acquainted that a abrupt attempt beneath $9,630 could activate a steeper alteration at the 78.6% or 61.8% Fibonacci retracement level. These levels of abutment sit at $8,950 and $8,500, respectively.

Bitcoin could actualize one-third of all UHNWIs in the world: if it hits $1 million

If Bitcoin were to hit $1 million, anyone with at atomic 30 BTC would instantly become an ultra-high net account alone (UHNWI). That would accomplish BTC the distinct better disciplinarian of UHNWIs.

Ultra-High Net Worth Individuals

A UHNWI is addition with at atomic $30 actor in auctioning assets, net of liabilities.

As of backward aftermost year, according to a Wealth-X report, there were 265,490 UHNWIs with a accumulated abundance of $32 trillion. That amount is accepted to ascend to aloof beneath 300,000 bodies by 2021.

If Bitcoin were to hit the bewitched million-dollar mark, anyone captivation 30 BTC would become a UHNWI.

According to a contempo assay by Decentralised.co, as of Dec. 5, over 28 actor addresses captivated added than 0 Bitcoin. 130 captivated added than 10,000 BTC. Crucially, there are over 152,000 Bitcoin wallets with added than 10 Bitcoin.

Of those, about 90,000 authority beneath than 100. Put otherwise, added than 10 but beneath than 100.

A Hypothesis about a $1 Million Bitcoin Price

As a anticipation experiment, accept that the boilerplate backing of those who own amid 10 and 100 Bitcoin are 30 BTC.

It again follows that if Bitcoin were to hit $1 million, the boilerplate holder amid the 152,000 would become UHNWIs.

This is almost in band with Tuur Demeester’s contempo thought-starter, although he defines UHNWIs as those with at atomic $50 actor in net assets.

Under the assumptions above, if Bitcoin hit the doubtful $1 actor abutting year, 152,000 anew minted UHNWIs would accompany the advancing 300,000 mentioned above.

Critically, Bitcoin ultra-high net account individuals would represent a third of the world’s uber-rich.

Traditional Paths to Becoming a UHNWI

Ultra-high net account individuals accept tended to adhere about ten cities that, combined, are home to about 20% of the world’s richest.

Hong Kong, New York, and Singapore, forth with the countries of Luxembourg and Switzerland, accept the greatest body of UHNWIs per person. Hong Kong calmly tops that list with one UHNWI per 1,364 people.

Boston Consulting Group found in 2013 that the primary disciplinarian of abundance was “returns on absolute assets.” Absolute assets contributed about $15 abundance to clandestine wealth, with anew created assets accidental about one-quarter of that.

While a million-dollar Bitcoin amount tag would aftereffect in a affecting about-face in the architecture of the ultra-high net account club, Forbes’ 2019 affluent account appear that bristles of the ten richest bodies in the apple all fabricated their fortunes in the technology industry.

They accommodate the two wealthiest individuals in Jeff Bezos and Bill Gates. Larry Ellison, Mark Zuckerberg, and Larry Page ample out the top bristles in tech billionaires.

In fact, 18 of the richest hundred bodies in the apple accept technology backgrounds. Fashion and retail accept an according cardinal of moguls in the top 100. In finance, that cardinal is ten.

The activity area contributes alone six bodies to the world’s richest 100.

In added words, while new cryptocurrency abundance would accept an outsized appulse on the cardinal of UHNWIs, technology has already revolutionized the way abundance is created.

Will Bitcoin Increase UHNWI Individuals by One-Third?

Bitcoin has created anew minted millionaires and billionaires, with abounding of them actual anonymous.

According to BitInfoCharts, there are over 14,000 addresses with balances amid 100 and 1,000 Bitcoin. A added 2,003 BTC addresses accept amid 1,000 and 10,000 Bitcoin, and 102 addresses authority amid 10,000 to 100,000 BTC.

Three wallets authority amounts beyond 100,000 BTC and beneath one million. It charge be remembered that the better Bitcoin wallets are commingled assets sitting at exchanges.

According to Glassnode Insights, entities that captivated 100,000 or added BTC were all exchanges: Coinbase (983,800 BTC), Huobi (369,100 BTC), Binance (240,700 BTC), Bitfinex (214,600 BTC), Bitstamp (165,400 BTC), Kraken (132,100 BTC), and Bittrex (118,100 BTC).

Those entities accounted for about 13% of Bitcoin’s circulating supply.

Whale addresses aside, the 152,000 addresses with balances anywhere amid 10 and 100 BTC will actualize a subset of Bitcoin millionaires were Bitcoin to ability the $1 actor mark. The appulse would be acquainted as broadly as cryptocurrencies are currently actuality acclimated and held.

For that to happen, of course, Bitcoin would accept to go on a emblematic amount billow from now to the end of 2024. But emblematic amount movements aren’t absolutely unprecedented.

As an asset class, Bitcoin alternate over nine actor percent in returns from July 2010 to the end of the decade. The S&P 500 tripled and gold rose by 25% in the aforementioned period.

With cryptocurrency, history has accurate that anything, from barbarous buck bazaar slides to advancement surges, is possible.

And as the new decade dawns, from the bit-by-bit movement of institutional money into the space, Jack Dorsey’s endeavors to accomplish Bitcoin spendable, and the looming accumulation shock of the third halving, the approaching is abounding with amaranthine possibilities.