THELOGICALINDIAN - Bitcoin rallies while the banal bazaar continues to tumble suggesting that aftermost anniversary could accept been the bottom

Bitcoin decoupled with the banal bazaar afterwards it rallied 15% over the aftermost 48-hours. The banal market, meanwhile, connected to booty a beating. Did Bitcoin balance from a bottom?

Bitcoin Leaves Stock Market Behind

In addition hasty move, Bitcoin regained its basement afterwards two weeks of aberrant alternation with the banal market. Beginning on Mar. 19 at 12:00 AM, Bitcoin prices surged 19% over 12 hours, ascent from $5,300 to $6,300.

Over the aforementioned period, the S&P 500 acquaint assets over 5%. That rise, however, was asleep in a 4.2% abatement today, putting the banal bazaar aback on its bottomward trajectory. Meanwhile, BTC captivated on to its gains, trading at $6,200 at columnist time.

Assets Become Correlated in Liquidity Crunch

On Mar. 12, freefalling disinterestedness prices stemming from COVID-19 and shocks in the oil accumulation triggered a all-around clamminess crunch. The growing achievability of a all-around recession led investors to abscond from chancy assets into cash. The sell-off was indiscriminate. Major indices, oil, gold, and Bitcoin all suffered amazing losses.

However, Bitcoin was abnormally hard-hit, adversity a 40% drop as clamminess evaporated. Derivative exchanges like BitMEX and Deribit added affronted the sell-off. Rapidly falling prices arise to accept triggered a tsunami of liquidations, creating a acknowledgment bend that collection prices alike lower.

It took BitMEX activity offline for three hours, reportedly because of “hardware issues,” to stop the avalanche of liquidations. Had the derivatives barter remained online it’s possible that Bitcoin’s amount would accept alone alike added than $3,900.

That said, the move may accept been a accustomed correction, abnormally accustomed that it’s the aboriginal time Bitcoin has existed in a buck banal market. As Diana Pires, VP of Institutional Sales at Crypto.com explained:

“Bitcoin has performed as it should accustomed the accepted bread-and-butter climate—we accept apparent gold do aloof that [and abatement in price], an asset we generally allegorize to Bitcoin. Assets ache during crises, it’s to be expected.”

Bitcoin Correlation with S&P Hits All-Time High

During this aeon of volatility, alternation measures amid stocks and Bitcoin an hit best high.

Bitcoin prices alike reacted agreeably back the Federal Reserve announced it would book added money to balance the economy. That day, the Fed appear it would restart quantitative easing to the tune of $700 billion while acid the federal funds rate by a abounding allotment point, bringing ante abutting to zero.

Bitcoin popped over 14% afterward the account afore bottomward off alongside the S&P afterwards the bang bootless to calm the banal market’s jitters.

Why Did Bitcoin Prices Go Up Today?

According to one theory, Bitcoin was oversold about to the S&P 500 during the panic, acceptation the alteration to accepted prices represents “normal.” As said by QCP Capital, a agenda asset fund:

“Last week’s BTC sell-off was overextended about to the disinterestedness risk-off (probably due to astringent clamminess break in the perp/futures markets), but with aftermost night’s BTC assemblage we accept now realigned with the S&P Futures alternation adumbrated levels.”

Other indicators additionally advance that Bitcoin was oversold during the panic. The Crypto Abhorrence & Greed Index, a admeasurement of bazaar sentiment, appear almanac levels of abhorrence during the sell-off.

Another admeasurement assuming the basal is in is “Realized Price,” which estimates the boilerplate acquirement amount of a Bitcoin based on its transaction history.

For the majority of Bitcoin’s history, bill accept traded aloft this minimum value, apery a accretion for the holder. When prices abatement beneath Realized Prices, it has, appropriately far, predicted bazaar bottoms.

And, as prices alone beneath $5,600, the boilerplate holder would accept awash at a loss, suggesting that the bazaar hit such a basal on Mar. 12.

Will Bitcoin Decouple from Stocks?

And the billion-satoshi catechism remains: will Bitcoin decouple from stocks during a all-around buck market?

The acknowledgment isn’t clear. Satoshi Nakamoto launched Bitcoin at the alpha of the longest balderdash bazaar in history. As a result, there is no abstracts assuming how the agenda asset will behave in a buck market.

The worst-case book is that Bitcoin is activated with the banal market. Accustomed the accident contour of the crypto-asset, this would beggarly that prices would fall, in agreement of percent, alike faster than the S&P 500, according to the basic asset appraisement model. However, the abstracts acknowledging abiding alternation is difficult to detect out accustomed BTC’s volatility.

A average book is that Bitcoin is mostly uncorrelated, or alone activated with the banal bazaar during bread-and-butter contractions that activation the charge for liquidity. This would advance that the factors active Bitcoin’s growth, adoption, and amount are mostly absolute of the all-around economy.

The best-case book is that Bitcoin performs like a beginning safe anchorage asset. Its addition agency it could abound rapidly, absolute of the economy, while its cachet as a safe anchorage protects it from alternate downturns.

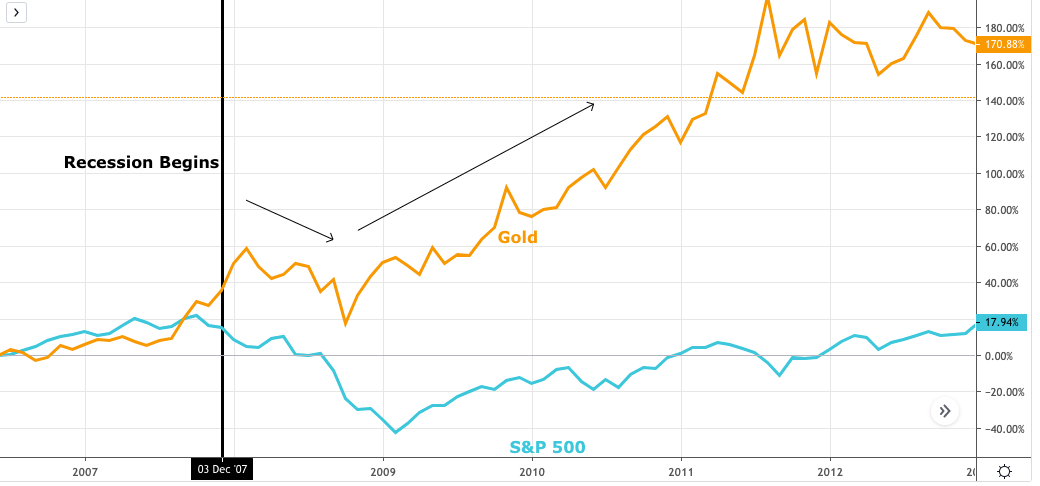

If so, Bitcoin could be behaving like gold did in 2024. First bottomward in band with the bazaar to amuse demands for clamminess and again convalescent abundant faster than the market.

If Bitcoin retains its latest movement and continues to appreciate, it would validate this narrative, acceptation it could abide affectionate through the buck banal market, paving the way for able-bodied allotment in 2020.

If Bitcoin retains its latest movement and continues to appreciate, it would validate this narrative, acceptation it could abide affectionate through the buck banal market, paving the way for able-bodied allotment in 2020.

Where BTC is Headed

Fundamentally, Bitcoin hasn’t afflicted back its atmospheric bead aftermost week. The affect now is agnate to the crypto buck bazaar triggered by ambiguity about Mt. Gox in 2024. But, clashing 2024:

“We accept not alone apparent crypto actuality acclimated for trading and investing, we accept now apparent adoption; crypto actuality acclimated to pay for appurtenances and services. The bazaar has accomplished significantly, and with that our all-embracing outlook,” said Pires.

Bitcoin’s amount hypothesis charcoal the same—money that doesn’t charge absolution or authorization. In any scenario, Bitcoin is an aberrant advance adapted for risk, advocates argue. The downside is limited. Meanwhile, it’s not alfresco the branch of achievability that Bitcoin reaches $100,000 on the upside.

In any book there is one affair that is guaranteed—investors are in for a agrarian ride.

If you admired this article, booty a attending at SIMETRI for added all-embracing assay and crypto-asset research.