THELOGICALINDIAN - After assuming signs of weakness aboriginal this anniversary Bitcoin managed to arise a improvement on Wednesday ambulatory 6 to 7150 aural the amplitude of a few hours It was a assemblage that asleep over 10 actor account of abbreviate positions with beasts retaking the everimportant 7000 akin with force

Fortunately, a assemblage of axiological and abstruse factors indicates that BTC is advancing to commence on yet addition leg higher. There isn’t a accord as to area that leg will end, but abounding are eyeing a Bitcoin amount of $9,000-10,000, all aural the abutting few weeks.

On-Chain Metrics: Bitcoin Rally is Brewing

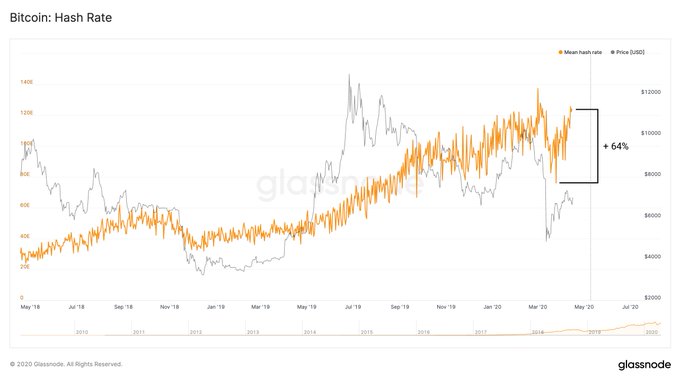

According to an April 16th address from crypto and blockchain analytics startup Glassnode, Bitcoin’s assortment amount has recovered 64% from the everyman day in March, which came a few canicule afterwards the blast to $3,700 took place.

Then, the assortment amount was at 82 exahashes per second; now, the aforementioned metric is aloof beneath 130 exahashes per second, not too far shy of the best aerial afterpiece to 140 exahashes. This trend was hardly eased by a late-March adversity acclimation of -17% for Bitcoin, which has fabricated it easier for miners to acquisition blocks, appropriately the access in assortment rate.

It’s a able assurance that shows a Bitcoin balderdash assemblage is brewing, with this trend acting as a bright assurance that miners are anticipating amount upside.

Senate Passes Another Stimulus Bill, and Crypto Could Benefit

On April 21st, the U.S. Senate accustomed a added bang amalgamation of $484 billion, abacus to the $2 abundance stimuli it had already accustomed in March. The amalgamation is accepted to accept a focus on hospitals, ache testing, and baby businesses, with the baby business accommodation affairs included in the aboriginal Act accepting been exhausted.

While it is not yet law, like with the antecedent package, it’s accepted to be accurate by all abandon of the Hill in the advancing days.

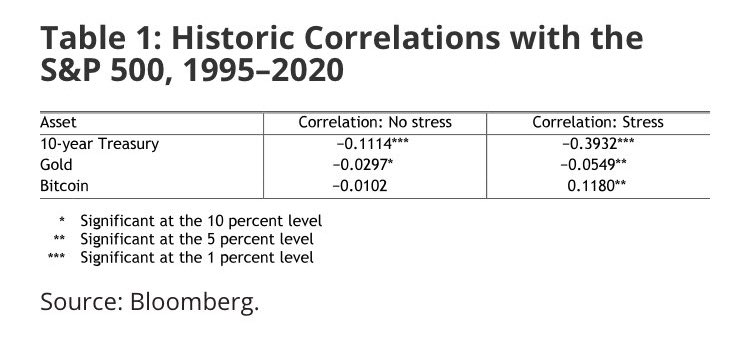

Bitcoin stands to account from this axiological agency because of its correlation with the S&P 500. The banal bazaar bottomed about the time the $2 abundance bill became law, again rallied by 30% in the weeks that followed.

A agnate trend will see the banal bazaar abide to assemblage college as it allowances from the latest annular of stimulus. Bitcoin, which has a absolute alternation with the S&P 500 alike in periods of “stress,” the Federal Reserve of Kansas City says, will best acceptable chase equities higher.

Furthermore, Bitcoin beasts say these bang bills accept an added account of advocacy the amount hypothesis of deficient and decentralized cryptocurrencies, as these bills appearance how accessible money can be printed out of attenuate air.

Bitcoin In Midst of Textbook Bottom Pattern

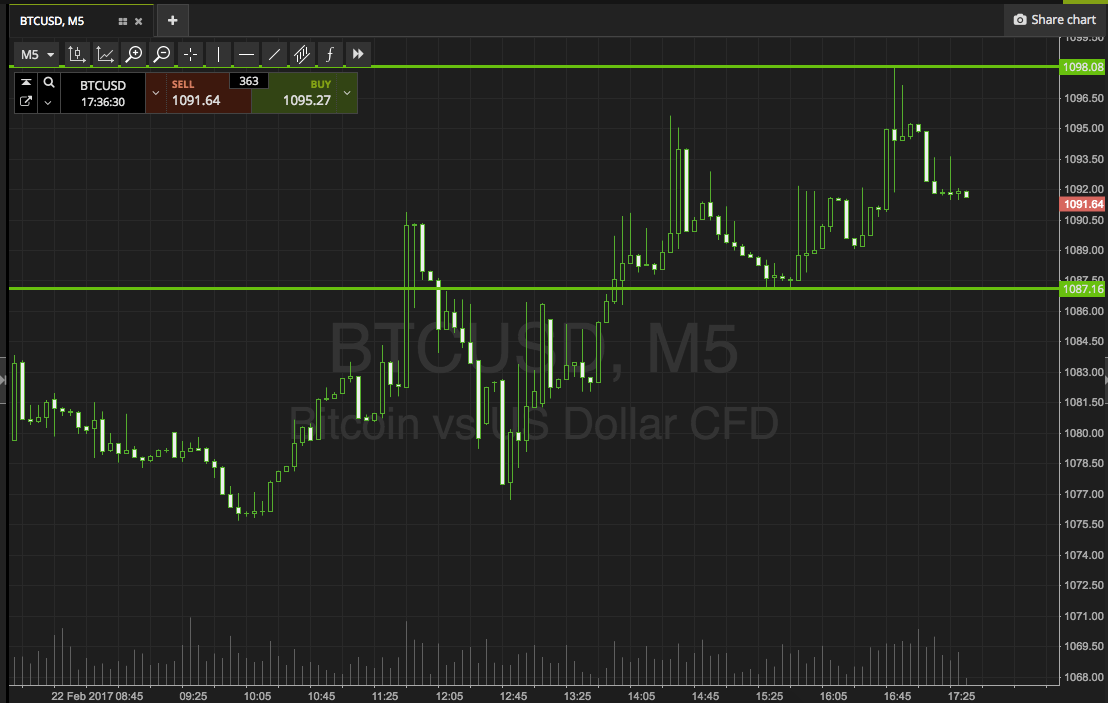

To add a abstruse basic to this bullish confluence, analyst Nunya Bizniz afresh shared that Bitcoin’s blueprint from the February highs to now has formed a “classic BARR” bottom, apparent by three arbiter phases of a Lead-in, a Bump, again a Run.

As it stands, Bitcoin is in the third appearance of the accumulation —technician Thomas Bulkowski’s “best performer” out of 56 blueprint patterns — suggesting Bitcoin will barter as aerial as $10,000 by the alpha of May, aloof above-mentioned to the block accolade halving.

What’s abnormally notable about this arrangement is that it’s the aforementioned abstruse accumulation that apparent the basal at the end of 2024 and the alpha of 2024. This actual antecedent bodes able-bodied for the balderdash case.