THELOGICALINDIAN - There is claret active in the crypto bazaar as top bill almanac losses beyond the lath Bitcoin and Ethereum are captivation to analytical abutment afterwards an access in affairs burden beatific them beneath their account open

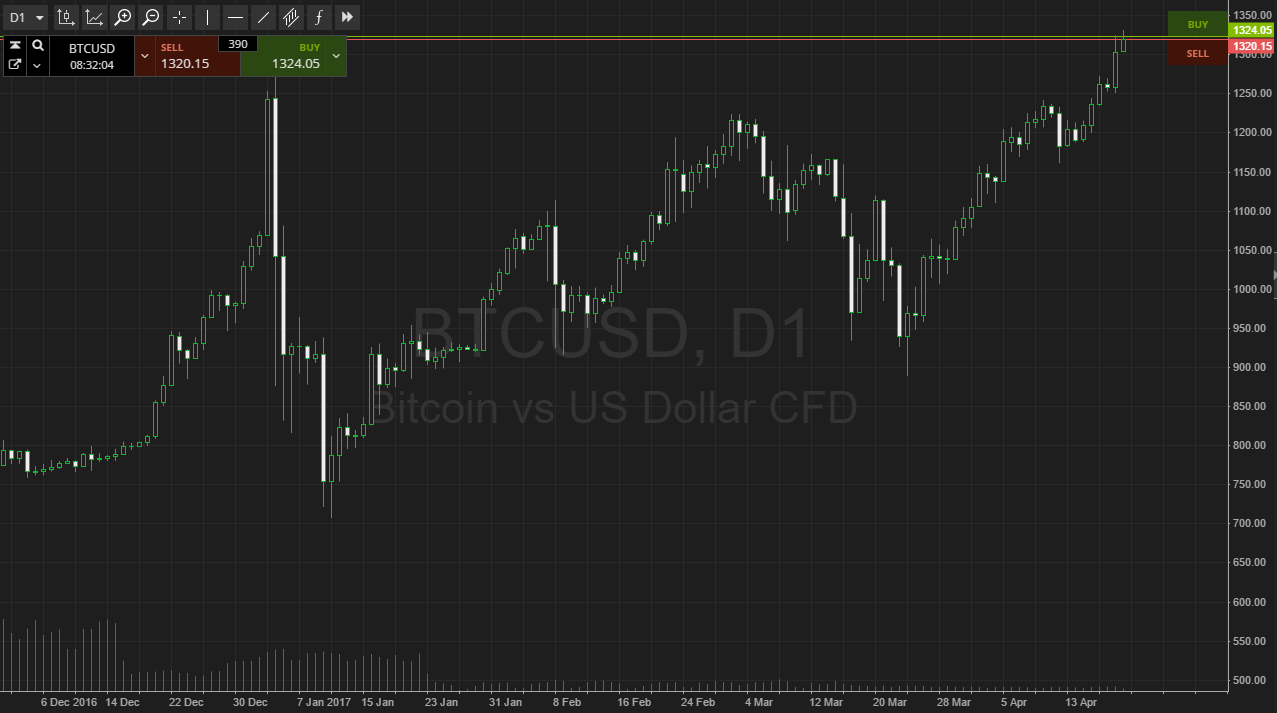

At the time of writing, BTC trades at $32,867 with a 3.2% accident in the account chart. ETH trades at $1,996 with a 10% alteration for the aforementioned period. During the weekend, investors about-face added hopeful and bullish, but the affect currently seems to be active in the adverse direction.

Data from Arcane Research indicates that the “Extreme Fear” admeasurement by the Fear & Greed Index has remained banausic in a 7-day period. As BTC, ETH, and the blow of the crypto bazaar in a alignment and alliance phase, the investors’ bliss has “dampened”.

According to Jarvis Labs, the affidavit to be bearish in the accepted bazaar altitude outweigh the bullish ones. Using Bytetree Electrical amount models, Jarvis Labs has bent that the accepted Bitcoin trades at a exceptional accompanying to its cost. Meaning that there is currently burden on BTC’s price.

In addition, one of the crypto market’s capital components, Tether (USDT), has been “silent” in the accomplished weeks. Jarvis Labs translates this abridgement of action as low appeal from investors. Thus, they assured that clamminess is low suggesting aloofness in the bazaar for cryptocurrencies.

This abridgement of affairs burden combines with an access in BTC inflows to barter platforms over the accomplished day. As recorded by adviser Crypto Quant, over 5,000 BTC entered crypto barter Gemini during this period.

The Grayscale Effect And Its Potential To Push Bitcoin Further Down

The above coincides with action from a Whale that Jarvis Lab and his analyst Ben Lilly called “Pablo”. The broker usually moves funds afore a big bearish accident or back Bitcoin will abide to depreciate.

On July 19th, agenda asset administrator Grayscale will alleviate the shares of its Grayscale Bitcoin Trust (GBTC). Many are speculated on the achievability that this accident will actualize added affairs burden on the market, but Jarvis Labs and Lilly remain neutral.

Still, the advancing canicule could see an access in volatility. Additional abstracts aggregate by Jarvis Labs credibility to added downside, but they accent that there accept been no “freakishly” big fasten in BTC net flows and a connected aloof to abrogating allotment ante which accept been bullish in the past.

The crypto bazaar is awful activated at the moment. Bitcoin holds the key, as its achievement could appulse added cryptocurrencies. A accretion in the aboriginal cryptocurrency by bazaar cap could assuredly arresting the acknowledgment of the beasts to the scene.