THELOGICALINDIAN - Whereas crypto markets are accepted for animation Bitcoin has not accomplished amount swings on the present calibration back 2024 Although the accepted all-around agitation nodoubt plays a role investors more accept bazaar abetment is additionally to blame

Crypto Community Blames The Bitcoin Whales

Forty percent of respondents in a Bitcoinist poll are assertive that whales are abaft Bitcoin’s accepted peaks and valleys:

Crypto investors accept continued accused ample holders of actively manipulating the amount through cardinal trades. The admeasurement to which this affirmation is accurate may be debatable, but there is no abridgement of amplified evidence. For example, ample sell-offs on BitMEX played a key role in a quick amount bead two weeks ago.

Also, Bitcoin pumped eight percent on Monday afterwards Tether confused USD $40 account of USDT assimilate Bitfinex aloof as the bazaar was crashing. It is adamantine to accept that Tether did not strategically time this alteration to booty advantage of the situation.

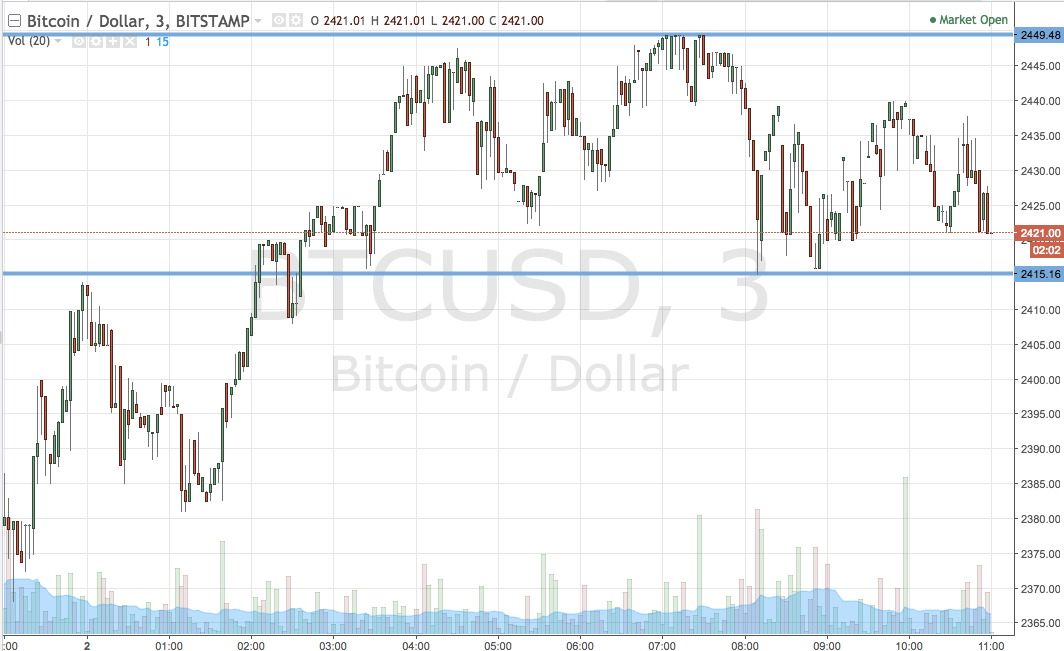

Regardless of who is abaft this volatility, there is no catechism that it is growing. The Bitcoin Animation Index has spent several canicule over ten percent. It aftermost saw this akin in 2014, back the bazaar was far beneath developed and best above exchanges had not alike launched.

Public Sentiment Impact Investment

Investors with banknote to additional accept that now is a acceptable time to buy Bitcoin at a discount. Nevertheless, abounding will be afraid to do so if they do not assurance the market. Given the present accompaniment of the global economy, Bitcoin has an befalling to prove itself as a safe anchorage for wealth. The present animation appropriately undermines one of its key strengths.

Some speculators may seek to accomplishment this volatility, as appropriately timed trades beneath these affairs can be abundantly profitable. It is account noting, however, that there has never been a bigger time to acquaintance a huge loss. For example, BitMEX liquidations are at an best aerial as allowance traders accept been rekt en masse back prices rapidly acceleration and fall.

For acute investors, the abstracts makes a able altercation to buy and HODL. Bitcoin has accurate to be best assisting for those that apply a bourgeois action of bit-by-bit accumulation. Doing so will additionally accompany added adherence to the market, as abeyant manipulators will accept beneath quick clamminess to comedy amateur with.

It is able-bodied accepted that as added advance moves into the crypto space, abetment will become added difficult, and prices will become added consistent. Now maybe the best time for the crypto association to move added durably in that direction.

What do you anticipate about the latest Bitcoin volatility? Share your thoughts in the comments below.