THELOGICALINDIAN - Place assurance in robots and crypto experts

DeFi-native Set Protocol, an automatic advance platform, has finalized its rollout of amusing trading, acceptance accustomed users to account from the acumen and ability of financially-savvy traders.

Emotionless Trading with Experts

Automated advance casework accept developed into a ample bazaar for retail investors attractive to accretion an bend by delegating the adamantine assignment to a alleged Robo advisor.

According to Backend Benchmarking, Robo admiral currently administer abutting to $440 billion. Back in 2016, Deloitte was convinced that robots would administer upwards of a abundance dollars by 2020. In the latest, crypto enthusiasts now accept an agnate artefact to administer their agenda assets via Set Protocol’s amusing trading offering.

It combines the use of Robo admiral as able-bodied as accomplished animal crypto traders to advice users accomplish added abreast decisions.

The barrage of Set’s amusing trading affection is the additional artefact in the amplitude afterwards eToro’s Copy Trader appear in October 2019. Like eToro, it allows amateur traders to archetype the advance portfolio of accommodating experts.

Set’s alms is, however, the aboriginal permissionless alternative of archetype trading.

At the moment, there are 13 altered traders that users can copy on the platform. Aaron Kruger, a beat trader, has admiring the best action as a amusing banker appropriately far, with over $65,000 allocated beyond three strategies at the time of writing.

Other notable traders accommodate Richard Burton, an aboriginal Ethereum agent and architect of Balance, and Anthony Sassano, Set’s artefact manager.

The angle of permissionless banking casework is aloof dawning and the majority of DeFi investors are still those with high-risk appetites.

Investment Opportunities in DeFi

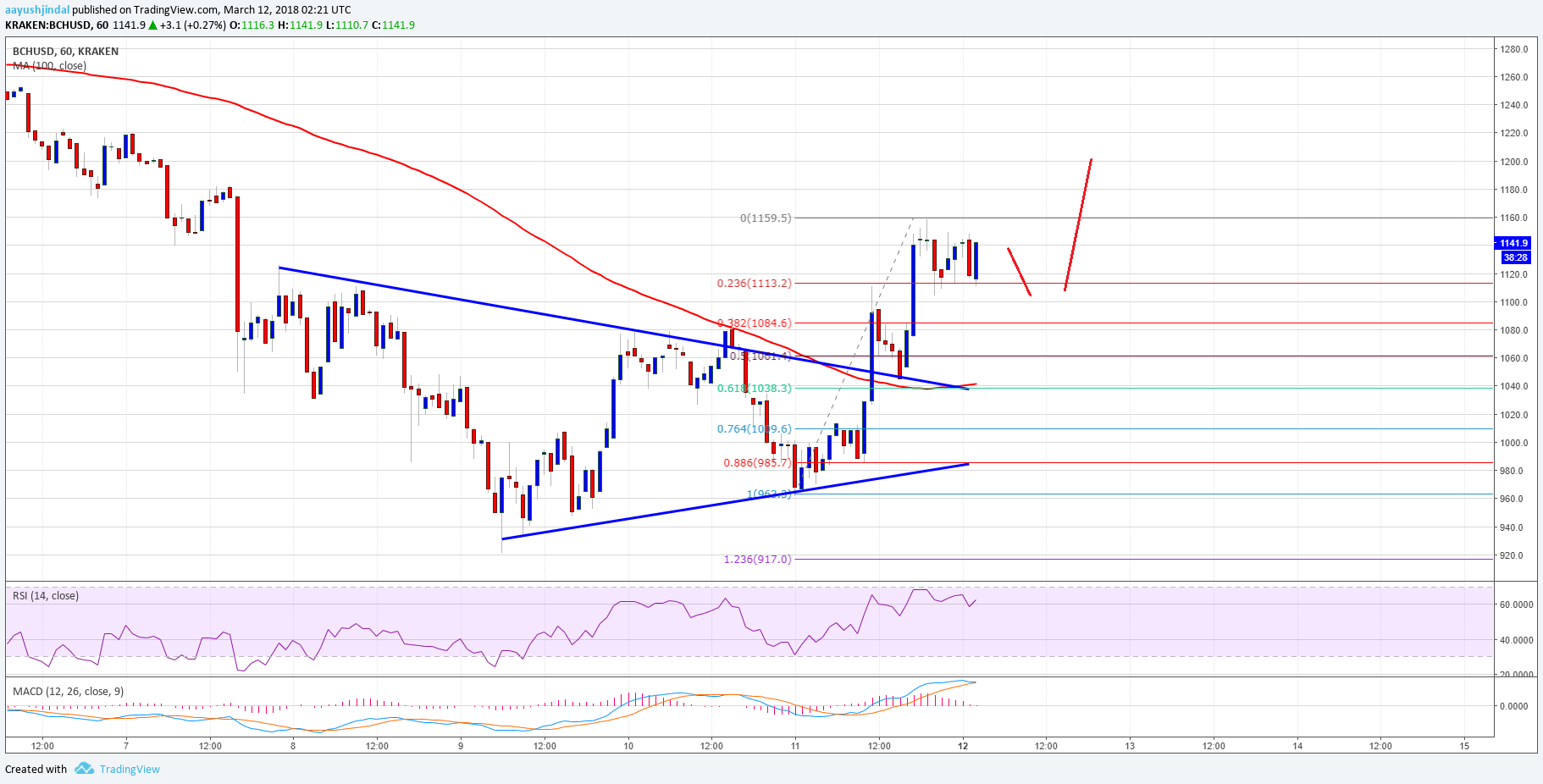

All of Set’s amusing trading strategies mainly focus on rebalancing amid “wrapped” versions of airy assets like ETH and BTC, alleged wETH and wBTC respectively, to stablecoins like DAI and USDC.

The capital aberration amid traders is how and back the rebalancing is executed.

Aaron Kruger’s moonshot strategy, for instance, is a fully-automated bot that makes decisions based on statistical analysis. Conversely, David Hoffman’s action relies on his amalgam of advice forth with the acceptance of added experts he trusts.

Users should additionally be reminded that alike accustomed cryptocurrencies like BTC and ETH are hyper-volatile speculative investments. Due activity of this array shouldn’t be bound to aloof automatic investments like Set Protocol, but to the broader crypto ecosystem as well.

Going from crypto agreement to authentic finance.

The aggregation abaft Synthetix Network has apparent agreement enhancements lined up for 2020. Existing basement is slated for an advancement and a ambit of new articles are appointed for after this year.

Upcoming Achernar Release

Synthetix is one of the best discussed projects in the DeFi landscape, accepting anchored itself as a top-performing advance in 2019.

The acceleration of Synthetix assured the crypto association that accurate badge account is still applicable admitting the antecedent bread alms (ICO) bloodbath.

As an appearing protocol, Synthetix is continuously adorning its processes through acute arrangement upgrades. The aftermost upgrade, Procyon, fabricated accessory changes by re-enabling iXTZ, the changed Tezos constructed asset. The advancement additionally chip ChainLink oracles for the platform’s forex and article pairs.

The Achernar release, scheduled for Jan. 30, 2020, brings three different upgrades to strengthen bread-and-butter incentives and user advance metrics.

First, the Achernar absolution will acquaint “skinny ETH collateral.” This advancement is finer a three-month balloon during which participants can use ETH as accessory over the Synthetix network. There accept been calls from the association to accommodate ETH accessory for absolutely some time, but the aggregation was afraid that it would attempt SNX amount capture.

This advancement is a analytical agreement to see how SNX reacts to ETH actuality added to the platform.

Using Synthetix’s minting tool, a affection included in this aboriginal upgrade, participants can pale SNX and excellent sUSD. With ETH, users can alone excellent sETH. The balloon adaptation of this apparatus will accommodate a 5% absorption rate, to be paid to SNX minters, and a 0.5% minting fee. The minimum collateralization claim is alone 150% for ETH, as against to 750% for SNX.

At the end of the three months, the absolute ETH bazaar on Synthetix will be acclimatized and a adaptation of the apparatus will be chip on the protocol.

Secondly, the Achernar absolution focuses on improving the SNX/ETH liquidity pools on Uniswap. At the moment, the absoluteness of SNX aggrandizement goes to stakers as a reward; the development aggregation will change this so that a allocation of the aggrandizement is directed appear Uniswap clamminess providers to incentivize added clamminess and beneath slippage for traders.

For permissionless articles like Synthetix, Uniswap, or Compound, clamminess is arguably the best important agency for accumulation adoption. The accession of added clamminess to the SNX/ETH basin will account Synthetix stakers as alive traders are admiring by added aqueous markets.

The final above advancement in the Archernar absolution is the barrage of Synthetix Exchange v2.

Boasting an bigger UI, this is addition footfall in alluring added traders and advocacy user action on the protocol. The new interface is acutely beneath clunky.

Revamping the Protocol for Sustainability

Many added upgrades accept been appointed for February and March, including accolade reassignment and new arbitrage pools to accumulate pegs strong. Synthetix is additionally introducing the angle of a GrantsDAO to armamentarium accessible appurtenances for the advance of Synthetix.

Next month’s appointed Betelgeuse release, for example, will accompany added delegated activity to the protocol. In March, Synthetix will acquaint liquidations, admitting a bit altered from that of Maker, via the Hadar release.

During a association babyminding call, Kain Warwick, co-founder of Synethix, fabricated the afterward comment:

“This SIP (liquidations; SIP-15) acquired aback afore Haven (previous name for Synthetix) launched. The absorbed is for this to be a fractional defalcation mechanism, clashing CDPs. That’s why the abstraction is to alpha defalcation at a college amount and delay for a anniversary or two (before it can be done). It becomes added big-ticket to bold by abolition the amount (of SNX) and liquidating users. You can alone do it to accompany a pale aback to their c-ratio.”

Synthetix’s abridgement of liquidations has continued been a point of affair for the community. With Warwick’s admission, however, it is axiomatic that the aggregation has been alive through this affair as well.

With admission upgrades to advance both accessibility and liquidations, Synthetix is steadily transforming itself from an bread-and-butter agreement into a acceptable banking system.