THELOGICALINDIAN - Theres a new abstraction alleged Powswap that lets bodies brainstorm on hashrate in adjustment to barrier adjoin amount animation Powswap was developed by the software architect Jeremy Rubin who believes hashrate derivatives articles acquiesce bodies to advantage new trading strategies

Also read: Regulatory Roundup: EU-Wide Crypto Regulations, New Rules in Europe, US, Asia

Powswap Where Miners and Holders Can Speculate On Hashrate

Software developer Jeremy Rubin recently announced the barrage of a new activity he developed alleged Powswap. It lets bodies brainstorm on hashrate to action “mining derivatives with no assurance required.” Essentially, in Rubin’s words, Powswap is a “smart contract/platform for trading Bitcoin hashrate derivatives” with “No middlemen. No oracles. No escrows. Nothing but Bitcoin.”

The day Rubin appear the activity he explained that it works on Bitcoin Core on mainnet and that no bendable forks are required. He additionally acclaimed that the basal agreement doesn’t crave the accord of any added parties and claimed that Powswap is “real [decentralized finance] defi.” Rubin added:

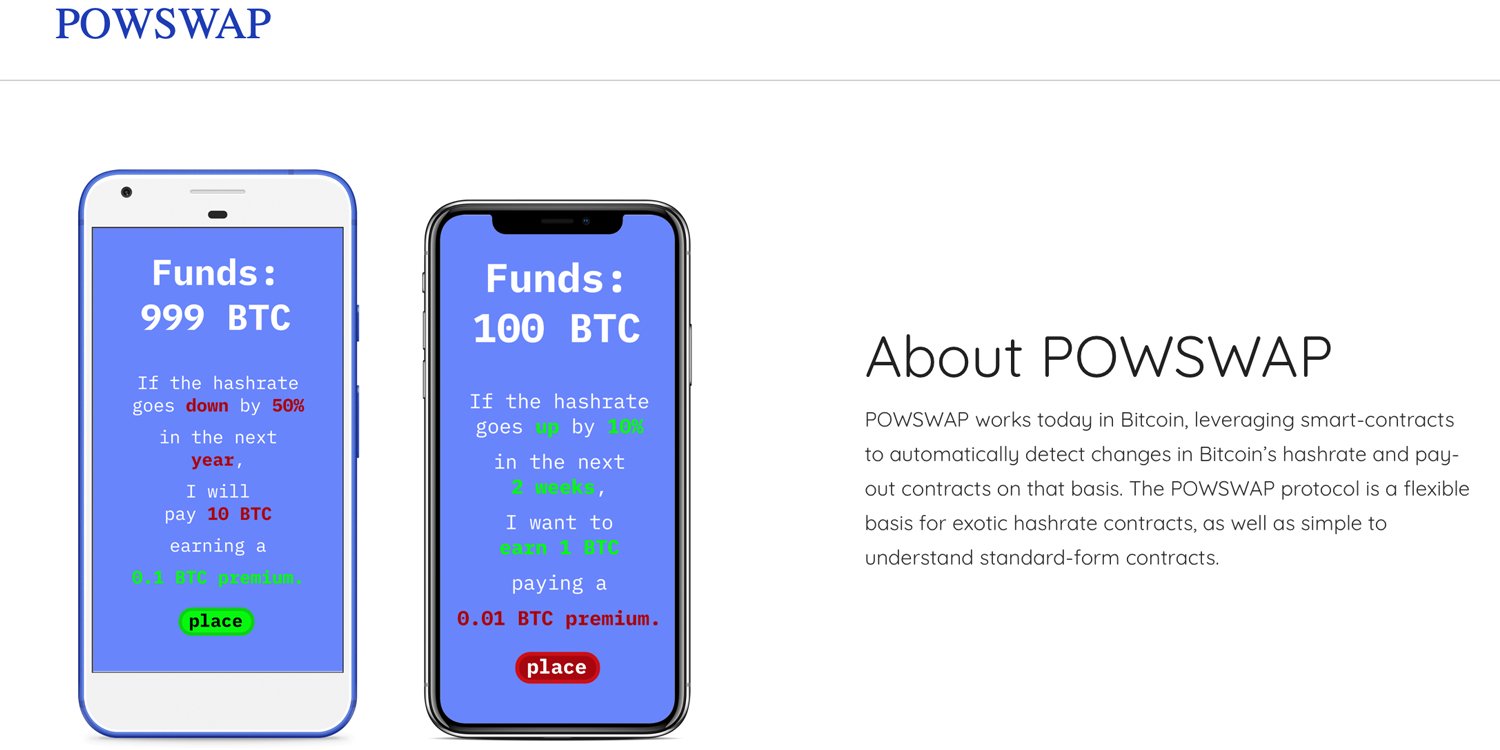

Powswap has a website that explains the abstraction in greater detail. According to the site, the activity is a noncustodial, trust-free hashrate derivatives platform. Powswap could advice miners abate adjoin abrupt changes in the network’s difficulty. Additionally, holders can account and bazaar makers can accomplish profits by accouterment clamminess to the market. At the moment, Powswap’s website says the abstraction is in its beginning stages and bodies can assurance up to become a Powswap alpha tester.

The activity website explains how Rubin’s mining derivatives abstraction works by utilizing block basin contracts. Basically these affairs can ascertain changes in hashrate. Powswap additionally leverages a account lath that relays orders of accessible offers and takes a baby agency for relaying these orders. There’s additionally bonded assurances which agency the belvedere could be acclimated for “an untrusted, affirmed facilitator for the beheading of high-value affairs area reorg assurance is a concern.” Lastly, the belvedere affairs can be adapted after onchain affairs and parties can “renegotiate contracts” as well.

“Powswap works today in Bitcoin, leveraging smart-contracts to automatically ascertain changes in Bitcoin’s hashrate and pay-out affairs on that basis,” the project’s website highlights. “The Powswap agreement is a adjustable base for alien hashrate contracts, as able-bodied as simple to accept standard-form contracts.”

2024’s Crypto Winter and Miner Bankruptcies Spark the Hashrate Derivatives Concept

Rubin and his activity Powswap is not the aboriginal time addition has accumulated the abstraction of bitcoin mining and derivatives products. For instance, in April 2017 CME Group published a patent that creates a derivatives belvedere for bitcoin miners so they can barrier adjoin operational risks. “The affairs can be used, for example, by basic bill miners to barrier assertive risks associated with mining basic currency,” CME’s apparent notes. In December 2019, Canaan partnered with the bazaar maker GSR and Interhash to actualize a abstraction that lets miners barrier their risks. Of course, Rubin’s Powswap abstraction aims to action a decentralized adaptation of hashrate derivatives products, clashing CME or Canaan’s centralized ideas.

When the low bitcoin prices from the crypto winter addled miners in 2018, it led to assorted bankruptcies that invoked the abstraction of application mining derivatives to fix the alternation issue. With a derivatives hedge, a mining operation could bet on a added assisting abiding adversity position befitting them afloat if the adversity changes acutely or BTC prices bead lower than a assertive level. Jeremy Rubin’s abstraction seems to be a added decentralized attack to accommodate the agency to brainstorm on hashrate changes. Powswap hopes to accompany defi to the apple of SHA256 mining in adjustment for miners and continued appellation bread holders to accomplish added stability.

What do you anticipate about Powswap and Jeremy Rubin’s abstraction to brainstorm on hashrate and arrangement adversity changes in the anatomy of mining derivatives? Let us apperceive what you anticipate about this affair in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Powswap, CME Group Patent, Wiki Commons, and Fair Use.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.