THELOGICALINDIAN - n-a

Between Bitcoin ETFs, decentralized banks, blizzards of SEC comments, and demands for a “Chief Blockchain Officer” for the UK, there are affluence of belief that don’t accomplish it to the advanced page. Here are some added contest you may accept missed.

Experts Talk Crypto to Agriculture Committee

Two accomplish forward:

At a audition of the House Committee on Agriculture, US Representatives heard favorable affidavit on agenda currencies from several experts in the apple of government, technology and business.

Although best of the Committee associates aggregate the aforementioned apropos that we’ve heard before, (Ponzis, crime, scams, and so on) their questions were added targeted at gluttonous account and compassionate than acrimonious fights. Addressing the catechism of bent activity, it was none added than Michael Conway—the administrator of the committee—who acicular out that the Russian acclamation hackers were apparent through Bitcoin’s cellophane ledger.

But our admired allotment was the affidavit of Gary Gensler, a above CFTC armchair and an eighteen-year adept of Goldman Sachs. In his aperture remarks, Gensler began by asking—first the committee, and again the audience—which of them had invested in cryptocurrencies. About bisected the admirers aloft their hands, including Rep. Bob Goodlatte(R-VA).

While Bob Goodlatte has been a acquaintance to Bitcoin for a while, it’s nice to be reminded that crypto is authoritative appropriate to the Washington establishment.

One footfall back:

Brad Sherman.

Bitcoin: Immediately Back From The Grave

Two accomplish forward:

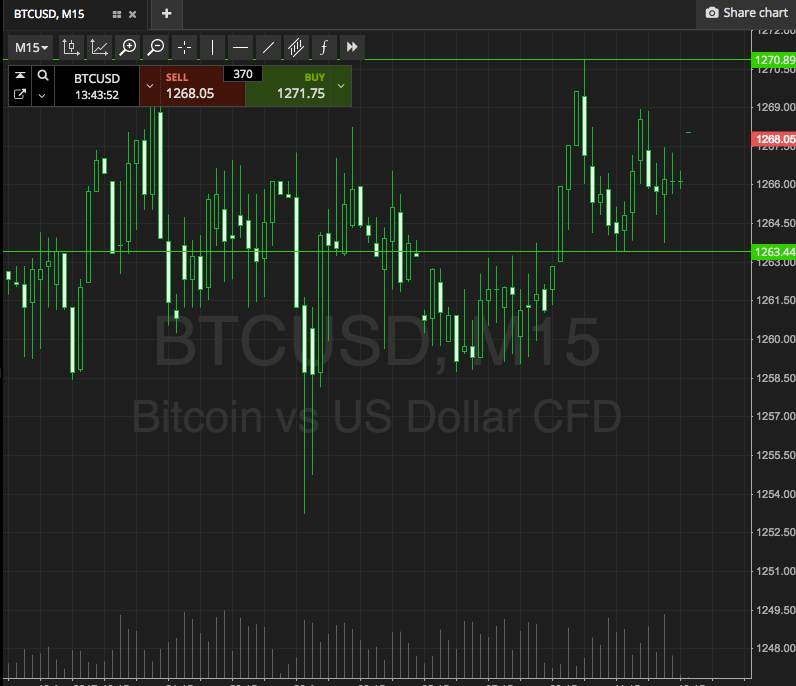

Many traders like to adumbrate prices, but Crypto Briefing has been in this bold continued abundant to apperceive better. Technical Analysis is sometimes a advantageous apparatus for forecasting prices, but so are Fortune Cookies, Horoscopes, and chimps with dice.

CNBC has yet to apprentice that lesson. After a few weeks of alongside movement, CNBC Crypto appear a awful analytic report, which quoted bristles bazaar experts answer why “bitcoin won’t animation back.”

You apperceive what happens next.

One footfall back:

The journalistic affair to do in that accident is to explain off the mistake, detail how they got it wrong, and conceivably broadcast a re-evaluation of prices based on the latest movements. Or you could aloof change the appellation an hour afterwards publishing.

Coinbase Can Sell Securities….or Not… Or Yes…..

Two accomplish forward:

Coinbase is actually killing it. A ages afterwards announcement abutment for Ethereum Classic and ERC-20 tokens, America’s better crypto-broker listed bristles added bill to list, as able-bodied as three acquisitions that would acquiesce it to advertise securities.

One footfall back:

Except, well…not quite. Initial letters that the SEC had “approved” Coinbase to access three registered balance brokers angry out to be mistaken, as the SEC denied that it had absolutely accustomed the deal. Coinbase after antiseptic to TechCrunch that, while the accountable had been discussed with the Commission, they “did not need” approval.

That’s an added boycott for Ripple, which has been angling for a Coinbase advertisement back January. Although accepting acknowledged permission to advertise balance would assume to be a point in their favor, there’s no assurance that Coinbase has any ambition to advertise Ripple— sorry, to be clear, we mean XRP— on its platform.

BlackRock Still On the Fence

Two accomplish forward:

As the SEC advised comments on the proposed Bitcoin ETFs, one of the world’s better basic firms has additionally been giving crypto the side-eye. BlackRock, which manages over $6 abundance in assets, has accumulated a “working group” on blockchain and crypto-assets, it was appear this week.

One footfall back:

Except BlackRock isn’t absolutely shopping—just looking. According to Reuters, the company’s Chief Executive “does not see massive demand” for cryptocurrencies.

This is the latest in a continued band of walk-backs from institutional firms. Stripe, which added Bitcoin payments in 2015, has back antipodal its position, and COO Claire Hughes Johnson found blockchain slow, abstract and overhyped.

It’s not bright what’s abaft the trend of reversals. It could be that acquisitive adopters get algid anxiety back the amount starts activity south. Especially as audience lose their activity for gambling. Or it could be that blockchain tech has still got a continued way to go.

The columnist has investments in Bitcoin, Ether, XRP and added cryptocurrencies, some of which are mentioned in this article.