THELOGICALINDIAN - Bitcoin abstracts accept absolved the latest address on cryptocurrencies by the Bank of International Settlements BIS afterwards it claimed Bitcoin charge stop application its ProofofWork algorithm

BIS: Bitcoin Must Drop Proof-of-Work

The report, ‘Beyond the doomsday economics of “proof-of-work” in cryptocurrencies,’ was appear January 21.

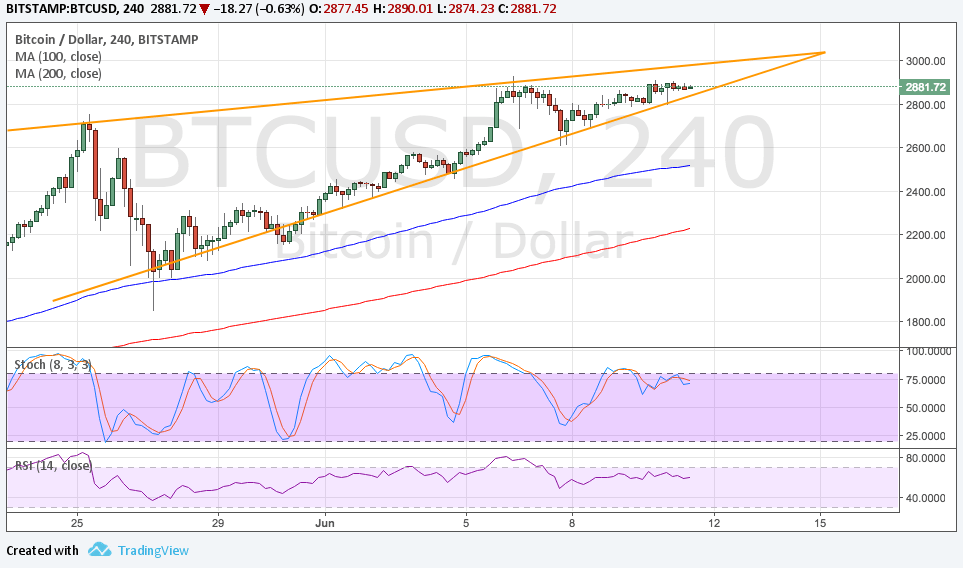

It focused on double-spend attacks aural cryptocurrency blockchains, as able-bodied as the abiding approaching of Bitcoin mining advantage and blockchain stability.

The BIS, additionally accepted as the axial coffer of axial banks, is able-bodied accepted as an abrupt analyzer of decentralized currencies in particular. Its antecedent announcements generated boundless criticism and alike badinage from the cryptocurrency industry.

“The abstracts are, first, that Bitcoin counterfeiting via ‘double-spending’ attacks is inherently profitable, authoritative acquittal certitude based on proof-of-work acutely expensive,” the latest paper’s columnist Raphael Auer writes summarizing its contents.

Lightning Network Doubts

As such, Auer continues, back block rewards ultimately become zero, there will be bereft drive on the Bitcoin blockchain and it could booty “months” to affirm a transaction.

The cessation ignores uptrends in fees, as able-bodied as the accumulated aftereffect of off-chain ascent technologies such as the Lightning Network, which already permits ample amplification Bitcoin’s transaction processing capabilities.

Auer mentions Lightning, but is broadly dismissive of it, saying:

In a anticipated backlash, cryptocurrency advocates lambasted the findings, with The Bitcoin Standard author Saifedean Ammous repeating calls for the BIS to appoint in agitation on its perspective.

Other reactions gave some application to the report’s logic.

“Have to accord BIS acclaim for anecdotic a appropriate Achilles’ Heel,” one Twitter user responded. “Fee bazaar incentives should work, but we can’t bandy it on a testnet to prove it. Bitcoin is the testnet.”

The cyberbanking accumulation this anniversary joins the Bank of England in throwing shade on Bitcoin. At the advancing World Economic Forum in Davos, Huw van Steenis, chief adviser to governor Mark Carney, said cryptocurrencies in accepted “fail basal tests.”

“They’re not a abundant assemblage of exchange, they don’t authority value, and they’re slower [than fiat],” he said.

What do you anticipate about the BIS’ latest report? Let us apperceive in the comments below!

Images address of Shutterstock