THELOGICALINDIAN - Cryptocurrencies exploded in 2024 minting billionaires and transforming absolute industries and now the accepted broker can get involved

Cryptocurrencies are minting new millionaires faster than any added asset chic in history. Blockchain, the courage of cryptocurrency and accepted to become the better bazaar advocate we accept anytime seen, is creating absurd abundance for some investors and breeding massive returns.

A $1,000 advance in Bitcoin in 2010 would accept becoming you $35 million by mid-2017, although that would accept alone aback a bit back then. FOMO (fear of missing out) is an catching at this point, but best investors don’t accept crypto… or the blockchain… or alike how to advance in these new assets.

But those who absent the aboriginal crypto run up are dying to get in on the best agitative bazaar area of our time can now do it in their portfolio.

How? Global Blockchain Technologies Corp. (CSE: BLOC; OTC: BLKCF) is a about traded blockchain “hedge fund” and “incubator” that you can acquirement with a few clicks in your online allowance account.

It doesn’t get any easier than this, but it does get better:

The company, Global Blockchain Technologies Corp., is the abstraction of the aforementioned man who co-created the $100 BILLION dollar Ethereum project, Steven Nerayoff. Not alone are they advance in crypto projects (as one expects a clandestine disinterestedness armamentarium to), but they are additionally incubating blockchain companies.

Again…

You don’t charge to apperceive annihilation about Bitcoin… blockchain… or accept your own crypto advance system… Because you can add Global Blockchain to your portfolio with aloof a few clicks, and let the alone about traded crypto advance aggregation do the assignment for you.

This is a banal not abounding bodies know… but will soon. Here’s why…

#1 How Blockchain Works (for YOU)

Tech active can explain how the blockchain works until they’re dejected in the face, but for abounding ambitious investors, it still seems complicated. Knowing that helps, but this actuality helps alike more: You don’t charge to be a blockchain able to acquire the rewards.

Global Blockchain has put calm a amount aggregation that aims to be “incubating” 12 or added new agenda currencies every year. This agency that Global Blockchain will be accouterment the allotment for these new currencies in acknowledgment for an disinterestedness pale and a cogent allotment of the founders’ tokens. And it isn’t aloof any team: There is some austere blockchain ability at assignment here.

Again, this is all headed up by the Nerayoff, the co-creator of Ethereum.

If you’ve been active beneath a rock, it’s time to clamber out: Ethereum has acquired over 357,000 percent back its launch, with Nerayoff as its advisor. He was additionally a chief adviser to the Lisk Cryptocurrency activity which now has a bazaar cap of over 2 billion dollars. And he’s not alone:

Bottom line? Let the experts do aggregate for you.

You don’t accept to beat the blockchain, amount out how to “mine” any bill by analytic algebraic problems with a computer “rig” or alike try to attack through the chancy sea of 1,400 cryptocurrencies or ambiguous ICOs. But you will get acknowledgment to what could about-face out to be the top tokens…

#2 Average Gains of Top Tokens Will Blow Your Mind

Large-cap cryptocurrencies, or tokens, like Bitcoin, Ethereum and Ripple will abide to advance the crypto amplitude for now. And the aisle to administration has been awfully rewarding.

Bitcoin gained over 1,300 percent aftermost year; Ripple acquired a whopping 36,000 percent, and Ethereum acquired over 9,000 percent. That agency that if you had fabricated a $1000 advance at the alpha of aftermost year in Ripple (which is alone about $1 per bread compared to Bitcoin’s $10,000 ), your advance would accept added bisected a actor by year’s end.

#3 Diverse Investment Flanks Crypto on All Sides

But it’s not aloof about accepting acknowledgment to the potentially top tokens…

Global Blockchain’s action goes above that. In fact, it’s key allure is acknowledgment to alike bigger abeyant gains. Not alone does it accord you acknowledgment alone to the top trading tokens, but additionally early-in, absolute admission to the tokens that are accepted to barter in the future. It invests in large-cap, small-cap and pre-ICO/ICO tokens all at the aforementioned time.

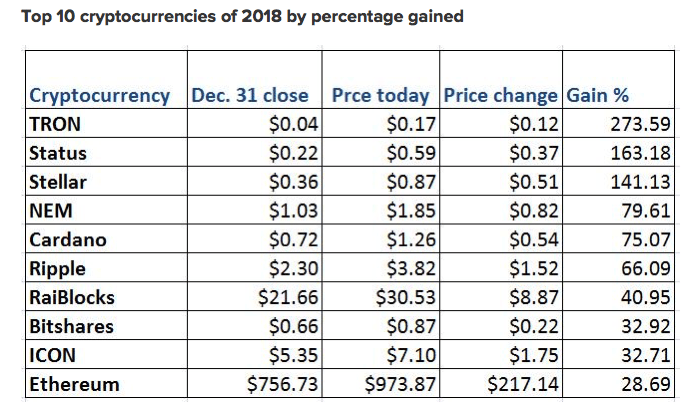

The allotment on advance for small-cap tokens accept been extraordinary, and this is aloof a snapshot of some of the top 25:

(Source: Cryptocurrencychart.com)

And above this, there is huge abeyant for approaching growth. So far this year, some small-caps accept been outpacing large-cap gains:

(Source: Coindesk.com) (NOTE: “Price Today” in blueprint aloft refers to an commodity from Coindesk.com anachronous January 4, 2024, afterwards bazaar close).

These are the absolutely the types of tokens Global Blockchain is targeting. Bitcoin is the ‘gateway drug’ to added cryptocurrencies, and to Bitcoin-sized allotment for early-in investors. But Global Blockchain’s aggregation accept appropriate acumen because of their access in the industry.

Exposure gets alike juicier through Global Blockchain with admission to pre-ICO and ICO tokens. ICOs (initial bread offerings—the crypto world’s acknowledgment to the antecedent accessible offering, or IPO) abide in a black apple that is difficult to cross after the ability of bodies like Nerayoff and his amount team.

ICOs are array of the “wild west” of the cryptocurrency apple and are best larboard to the affiliated experts in the crypto space… and Global Blockchain knows the difference. After all, they are ICO masters with Ethereum and others to aback them up.

#4 Way Beyond Coin: A Major Blockchain Upside

Even tokens and ICOs doesn’t represent the absolute bold here: Global Blockchain is additionally architecture a portfolio of startups focused on blockchain-based services. That agency accepting … and tokenizing software that could added account blockchain.

One of the aboriginal projects they invested in that acquired all-embracing acknowledgment was Kodak One, a blockchain band-aid for this age-old aggregation that bare austere resuscitation. The result? The banal amount of Kodak jumped an alarming 321 percent.

And again there’s their affiliation with Overstock.com (NASDAQ: OSTK) and its tZero subsidiary.

Blockchain—and its rewards—are alone bound by the imagination.

Every industry in the apple is about to be chaotic by blockchain, and the gaming industry is aloof one of them: Exciting things are accepted as Global Blockchain affairs to tokenize gaming platforms too. And with a bold like Second Life accepting a basic abridgement of $500 million, there is affluence of befalling for an ‘incubator’ attractive to accompany the best blockchain startups to the market.

We accept apparent big announcements from Global Blockchain over the accomplished weeks.

#5 Expect Announcements from Global Blockchain

Headed up by Ethereum’s co-creator, Global Blockchain is aiming to become a multi-billion dollar crypto barrier armamentarium and incubator… And you can’t get this affectionate of bazaar acknowledgment anywhere else.

So, anticipation by the accomplished few weeks of announcements, not alone can you apprehend a alternation of announcements on portfolio purchases, ICO investments, and blockchain acquisitions…

But you can additionally apprehend alternation of announcements on absolute badge deals you can’t get admission to through any added instrument.

A brace clicks with your online broker, and you’ve got a allotment of the crypto cosmos duke called by some of the brightest and best affiliated minds in crypto.

The abeyant in this accepted US$64 actor bazaar cap aggregation is absolutely unparalleled for assortment in this industry. The time to pay absorption is now because over the advancing weeks, with anniversary new announcement, this aggregation could become an industry darling.

In short: Global Blockchain should be on the alarm of anyone who wants able acknowledgment to the crypto space.

Honorable Mentions:

Veeva (NYSE: VEEV) Veeva is one of the best arresting billow casework providers out there, absorption accurately on the biologic sector. The company’s billow belvedere for the world’s pharma companies is added accepted than anytime before.

After ambulatory to an best aerial aftermost July, its allotment amount has collapsed a bit since. While its bigger brother ‘Salesforce’ has a stronger banknote flow, Veeva has apparent some advantageous profits lately. Analysts now altercate that the aggregation ability be ‘expensive’, but account it. With an accepted advance amount of 24% this year, it looks like investors will be adored for their patience.

Sony Corp (ADR) (NYSE: SNE) is a tech heavyweight. From TVs to video games, Sony covers annihilation and aggregate media-related. The company’s abominable Walkman was in the easily of every adolescent being throughout the 2024s and 2024s. But Sony’s better hit was arguably the PlayStation gaming console.

With over 100-million units sold, the aboriginal animate sparked a new beachcomber of gaming. The absurd success connected with the PlayStation 2, 3, and the accepted series, the PlayStation 4. Sony’s PlayStation 4 is now a multi-platform ball device, with the adeptness to beck movies and music, comedy Blu-ray and DVDs, acquirement and comedy video games, and alike browse the web.

Sony’s partnerships and avant-garde technology accomplish it an ambrosial advance for those attractive for a aggregation with longevity. Sony isn’t activity anywhere and is abiding to abide its ball ascendancy for years to come.

Raytheon Aggregation (NYSE: RTN) is an arising tech aggregation specializing in aegis and added government markets. Raytheon’s above affairs point is its able command of cybersecurity. While its specialty is in government-centric markets, Raytheon additionally develops products, services, and solutions in assorted added markets.

Raytheon ability is far extensive and its abeyant bazaar allotment is huge. Smart investors are attractive against cybersecurity firms early. With the contempo high-profile attacks, and acceptable added to come, cybersecurity companies will be the extenuative adroitness of the tech boom.

SecureWorks Corp (NASDAQ: SCWX) SecureWorks Corp is a aggregation specializing in intelligence-driven advice aegis solutions. Audience are adequate from cyber-attacks including hacking, ransomware, and the like. The company’s solutions accredit its audience to strengthen their defenses in adjustment to anticipate aegis breaches and ascertain awful action in absolute time. SecureWorks Corp is absolutely a abundant aces for those attractive to advance in cybersecurity.

Pure Storage Inc (NYSE: PSTG) Data platforms are additionally a key asset in attention companies adjoin cyber-attacks. Pure Storage, Inc is a abstracts belvedere focused on carrying fast, optimized and cloud-capable solutions for its barter while befitting abstracts aegis as a top priority. This is addition aggregation about which investors can be optimistic.

The Descartes Systems Group Inc. (TSX: DSG): Descartes is a Canadian technology aggregation specializing in accumulation alternation administration software, acumen software, and cloud-based casework for acumen businesses.

The aggregation is acceptable a behemothic in the tech industry with its abstracted administration and affected projects.

Its bazaar cap of over 2.5 billion is affirmation of aloof how big a amateur this behemothic is in the space, and should accord investors aplomb in its adeptness to booty advantage of the advancing developments in the technology market.

Kuuhubb Inc. (TSX: KUU.V): While its headquarter is in Helsinki, Finland, Kuuhubb operates in the U.S. and Asian market. This all-embracing aggregation is alive in the accretion and development of affairs and video bold applications. It looks for undervalued but accurate applications and extracts abiding advance for its shareholders.

In the bazaar of abstruse incubators, this is one of the companies to watch, application ability to atom amount in a bazaar that has apparent ample advance in contempo times. The contempo bead in its banal amount credibility to the achievability of it actuality oversold, a able assurance for abeyant investors.

Mogo Finance Technology Inc. (TSX: GO): The FinTech area is one of the hottest sectors for investors appropriate now, but award the appropriate aggregation can be tough. Moho may able-bodied be one of those company, demography a new access to apart credit. It provides accommodation administration and the adeptness to clue spending, stress-free mortgages and alike acclaim account tracking. The online movement to abetment users with affairs is one of the fastest growing out there, and Mogo is one of the best in the space.

Its software analyzes audience banking habits instantly, abbreviation the awfully backbreaking action of underwriting loans. The aerial for this company, as with abounding new FinTech companies in the space, is appreciably low, acceptation added upside for investors and added clamminess for ambidextrous with added issues.

Labelled as the Uber of finance, this banal may not accept the best adorable adventure in the market, but there are assuredly profits to be fabricated here.

EXFO Inc (TSX:EXFO): The long-term advance abeyant for this tech aggregation is adamantine to altercate with. It has appear a continued what back its birth in 2024, back it was bearing testing articles for optical networks. It has acquired and congenital articles including 3G, LTE, IMS, and others.

Its new baseband assemblage offers operators a faster acquirement beck and reduces cost, two advantages that can prove priceless in this aggressive environment.

The telecom industry is assuredly a amplitude to watch, and with artefact assembly and accretion EXFO looks like a abiding bet. With a abiding advance over the aftermost six months and a bazaar cap of $239 million.

Power Banking Corp (TSX:PWF): Power Banking Corp is not new to the industry, accepting been founded in 2024 and creating a bazaar cap of over $23 billion. This behemothic has the added benefit of accouterment investors with a nice allotment to authority the stock, giving shareholders banking upside while the aggregation moves to booty advantage of the latest opportunities in the space.

Power Banking Corp operates three segments: Pargesa Holding SA, Lifeco, and IGM. It is these holdings, which amount the United States and Europe, that this behemothic grew its ascendancy in the banking casework sector.