THELOGICALINDIAN - Leading cryptocurrency Bitcoin is cementing its position as a boilerplate macro asset

As cryptocurrency was advertised on TV screens civic aftermost week, and in the pages of the Financial Times, the bitcoin acceptance blitz has intensified. Day trading amusing media mogul Dave Portnoy is dabbling in cryptocurrency, and MicroStrategy, a listed aggregation with over $1 billion in revenue, has called bitcoin as a assets asset. Even above agnostic George Ball, administrator at advance close Sanders Morris Harris, has brash investors that Bitcoin is a safe bet.

These axiological developments accept buoyed the crypto market. Ethereum has burst through the $400 akin to hit a two-year aerial at $440, defying critics who are actively debating the accumulation of the cryptocurrency on Twitter, and appearance assets of added than 400% back the March low.

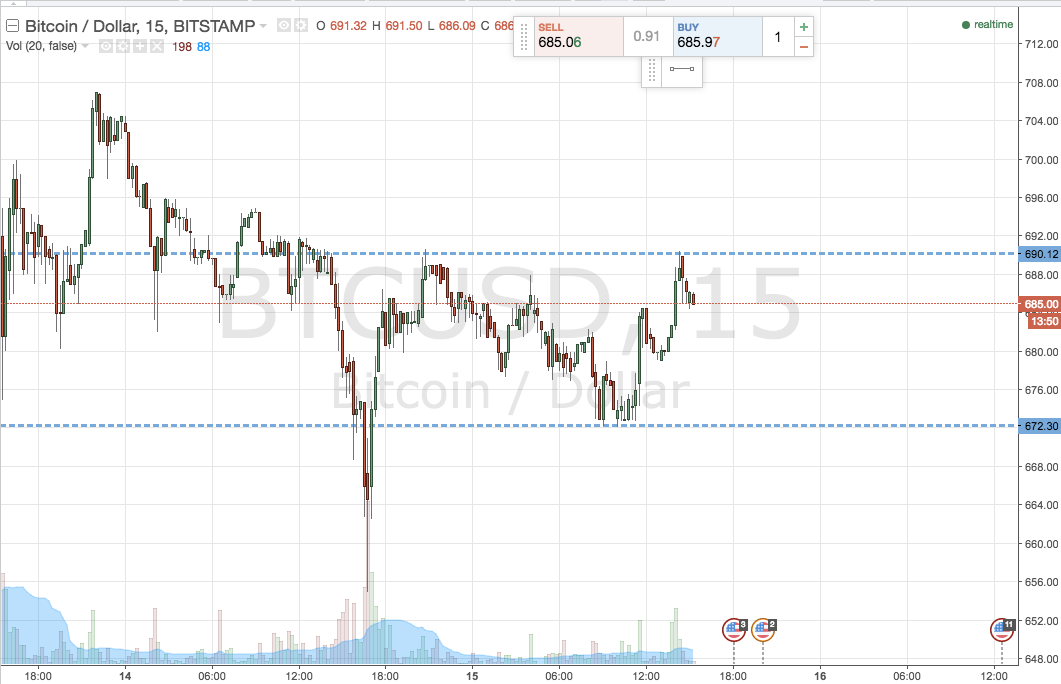

Bitcoin meanwhile has bound recovered from a abrupt bead aboriginal aftermost week, to already afresh advance adjoin key attrition at the $12K level.

This Week’s Highlights

In a watershed moment for cryptocurrency, Nasdaq listed software close MicroStrategy has invested bisected of its treasury into Bitcoin. CEO Michael Saylor said the “distinctive properties” of the cryptocurrency will “provide not alone a reasonable barrier adjoin aggrandizement but additionally the anticipation of earning a college acknowledgment than added investments.”

As a billion-dollar close backed by the banking giants BlackRock and Vanguard, MicroStrategy’s move gives the blooming ablaze to added companies in accumulated America that ability be because adopting Bitcoin as a assets asset. And, as arresting funds including the California and Oregon accessible agent alimony affairs authority MicroStrategy, millions of American citizens are now alongside apparent to Bitcoin.

Delegated Proof of Stake (DPoS) bill Tron and EOS are authoritative above moves as traders contemplate the DeFi ecosystems that could appear on these next-generation blockchain platforms.

Tron has surged about 30% afterwards architect Justin Sun accepted the development of decentralized barter agreement JustSwap, appearance over 300% assets back the March low.

Close behind, adversary EOS is blame appear 18% assets on the week, and about 200% from the bottom.

Bitcoin’s chain in beating abroad at $12K bodes able-bodied for the advancing balderdash run, with anniversary re-test of this key attrition akin increases the adventitious that it will be breached on approaching attempts.

At the aforementioned time, the balderdash narratives acknowledging the amount activity alone assume to be accepting stronger, with boilerplate choir now authoritative the case for bitcoin as an inflationary hedge, and DeFi mania continuing unabated.

The contempo bead in gold, however, could put buyers on edge, with a abeyant change of administration in the adored metal bazaar bouncing out to affect Bitcoin.