THELOGICALINDIAN - While Bitcoin companies in Australia accept been advancing beneath accretion burden from the countrys cyberbanking area bitcoin barter aggregate has been chugging forth seeing advantageous advance amidst an able environment

Also read: Workers Who Travel Internationally Will Benefit from Bitcoin

Bitcoin charcoal able in Australia

These aftermost few years, the Bitcoin industry in Australia has apparent an immense advance that has created a aggressive mural for barter operators and bitcoin startups in the country. But lately, Australian banks accept been closing all banking abutment and freezing the coffer accounts of abounding Australian cryptocurrency-based companies.

The better Australian banks accept been advancing bitcoin companies after any motivation; they accept been absolute cyberbanking abutment for companies accomplishing business accompanying to the agenda currency, arguing that bitcoin is a agent that facilitates money bed-making and added actionable activities.

Rupert Hackett, the Digital Currency Advisor to Dominet Digital Investment Group and Community Manager for the Australian Bitcoin barter buyabitcoin.com.au, told bitcoin.com:

“There is no official authoritative anatomy in Australia which will accord with Bitcoin, if you alarm up AUSTRAC or ACORN adage you anticipate you accept ‘red flagged’ a transaction as a abeyant scamming operation active out of Nigeria, they acquaint you it’s not their concern, Bitcoin is alfresco of their jurisdiction,” he continues.

The Australian Competition and Consumer Commission (ACCC) and Senator Matthew Canavan saw the Banks action as an actionable act and launched a abounding analysis to accept the acumen for this decision. This has acquired the Digital Currency industry in Australia to bandage together, basic an accord beneath the ADCCA (Australian Digital Currency Commerce Association) for the purpose of self-regulation and compliance.

The ADCCA has been disturbing to get some account from the banks and a bright absolution for their decision. Hackett says that “Banks are affected to comedy the role of de facto regulators for the Bitcoin industry.” This in turn, makes it commercially barren for Banks to accord with bitcoin companies. “It artlessly costs added for banks to ensure Bitcoin companies accommodated their centralized AML/KYC requirements than they acquire from their business. Without official regulation, Banking relationships are alienated and generally short-lived,” Hackett adds.

The Banks animosity has been banishment abounding Australian bitcoin businesses to about-face their backs on the agenda currency. Hackett stresses that:

In 2013,  The National Australia Bank appear an basic and aloof address in which it questioned if Bitcoin could alter the AUD. Then in 2014 the Australian Tax Office (ATO) appear its tax rules on bitcoin banishment barter affairs to be accountable to Tax. The taxation activated was the aforementioned as taxation laws for appurtenances and services, equating to 10% on the acquirement of Bitcoin.

The National Australia Bank appear an basic and aloof address in which it questioned if Bitcoin could alter the AUD. Then in 2014 the Australian Tax Office (ATO) appear its tax rules on bitcoin banishment barter affairs to be accountable to Tax. The taxation activated was the aforementioned as taxation laws for appurtenances and services, equating to 10% on the acquirement of Bitcoin.

Even admitting some European and U.S. Banks debris to accumulate bitcoin-affiliated accounts, these latest developments in Australia assume to be a accommodating abeyance of bitcoin exchanges by the country’s cyberbanking system.

Bitcoin exchanges in Australia

The ascent animosity appear bitcoin in the country has created a few blockades for bitcoin exchanges, banishment abounding of them to shut bottomward abruptly. This has accordingly fabricated it harder for bitcoin enthusiasts to barter their bill in the country.

List of exchanges, adulation of bitcoinx.io:

BTC Markets – The Bank of Queensland has accustomed the barter to abide open.

Independent Reserve – The barter has been able to abide open.

BuyaBitcoin – This allowance has managed to assignment about the difficulties imposed by the Banks and has been able to abide accessible after any issue. It is currently one of the best trusted exchanges in the country.

CryptoCoin Australia – Closed its doors due to abridgement of cyberbanking support.

DWV Exchange – Shut bottomward aftermost September because it couldn’t authority partnerships.

SpendBitcoins – SpendBitcoins apoplectic their casework and awash their belvedere to a third-party.

igot – The barter is still accessible but accepting a lot of issues.

Coinjar – Coinjar larboard Australia and now operates in the U.K.

Coin Loft – The barter has been able to abide accessible for business.

CoinTree – the barter is still accessible for business in Australia.

Bit Trade Australia – has additionally been able to abide accessible in Australia.

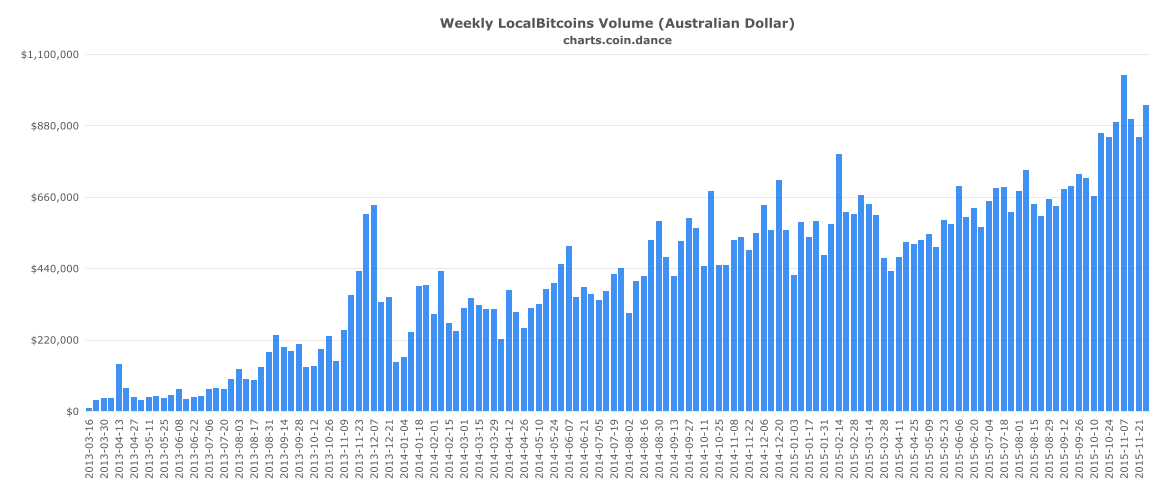

LocalBitcoins – The barter is still running, and it is a absolute archetype of how banks are not able of impacting Bitcoin’s decentralized nature. Below is the aggregate blueprint for the P2P barter in Australia, acutely assuming advantageous growth:

Despite the burden from banks, several exchanges accept managed to abide open. Even admitting there accept been austere setbacks to the agenda bill industry in the country, affluence of bitcoin affairs assume to appearance contrarily and acquaint a adventure of a advancing market.

[Editor’s note: the commodity has been adapted to accommodate a articulation to bitcoinx.io as an added source]

Do you anticipate banks can “shut down” Bitcoin? Let us apperceive in the comments below!