THELOGICALINDIAN - Money is a different affair it is universally accepted but abstract to about anybody What is money Why does it abide How is it controlled Money is cardinal to our lives as associates of a affable association yet conceivably one in one actor bodies will investigate into the attributes of money barter business and the rest

Also read: The Encryption Cold War: Government VS Internet

A General Overview

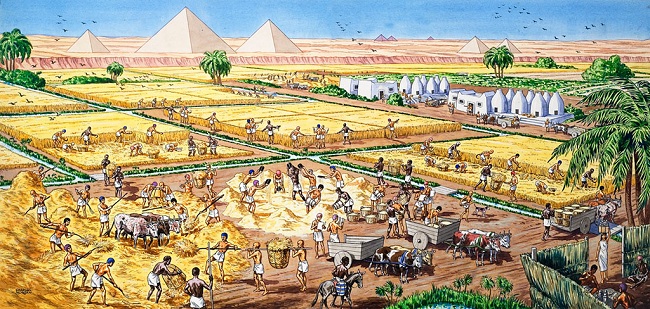

Money emerges through the chargeless and ad-lib coaction amid bodies in society. Whether through bargain exchanges or continued allowance systems, money develops as allotment of a analytic chase to ascertain efficiencies in trade. One hundred people, alms alone what they alone produce, charge argue owners of appurtenances they appetite to acquire their appurtenances in kind. It is difficult to acquisition a bifold accompaniment of wants in best cases. Other things equal, as individuals adopt added trading ally than fewer, there exists a addiction in such a bearings to action added bankable appurtenances as against to beneath bankable appurtenances back gluttonous what one wants.

Money emerges through the chargeless and ad-lib coaction amid bodies in society. Whether through bargain exchanges or continued allowance systems, money develops as allotment of a analytic chase to ascertain efficiencies in trade. One hundred people, alms alone what they alone produce, charge argue owners of appurtenances they appetite to acquire their appurtenances in kind. It is difficult to acquisition a bifold accompaniment of wants in best cases. Other things equal, as individuals adopt added trading ally than fewer, there exists a addiction in such a bearings to action added bankable appurtenances as against to beneath bankable appurtenances back gluttonous what one wants.

The agriculturalist who requires the appurtenances for his ability as able-bodied as appliance for his home, adornment for his wife, books for his son, etc. charge accompany his aftermath to bazaar to barter for such items – or, at least, for intermediaries that can anxiously be anticipation to backpack the amount for the barter of such things be anon wants. As anon as one being accepts a barter for an article which has no absolute use amount to him, that account has become a average of exchange. It has become a acceptable whereby at atomic one being is assured abundant in its bazaar clamminess and able abstruse activity to acquire it, for about abbreviate a time, in lieu of article he finds anon valuable. As assertive appurtenances attempt with others in the exchange of usage, the winners accordingly backpack attributes that logically absolve their accepting such as scarcity, backbone and fungibility.

Bitcoin’s History

This aisle is no beneath accurate for Bitcoin than it is for gold. Despite the differences in time scales, the aforementioned dynamics are arena out for this new currency. In the beginning, alone a few accurate believers bought into the idea. Eventually, a admirer called Laszlo bought pizza with bitcoin through his acquaintance as an intermediary. The actual aboriginal transaction set an antecedent accepted for approaching transactions. However beneath or overvalued the antecedent price, Bitcoin assuredly did accept a price. It had an bread-and-butter starting point. Over time, as hobbyists began to abundance bitcoin, they acquaint their electricity costs on internet bulletin boards and markets eventually developed. Now, there are dozens, conceivably a hundred, exchanges throughout the world, and Bitcoin’s amount keeps rising.

Money or Not?

A accepted aberration amid both laymen and able economists is to attach to an bottomless polarization. They say either article is money or it isn’t. To the admeasurement “money” is interpreted to beggarly “the best bartering acceptable in society,” this is clearly true. There can be alone one “most popular” of anything. By this standard, however, the alone affair that qualifies as money is the US Dollar. Euros, yen, pesos, and gold could not authorize as monies, because they are out-competed in clamminess by USD, and yet individuals in best countries can appoint in rational budgetary and bread-and-butter adding application added currencies.

A accepted aberration amid both laymen and able economists is to attach to an bottomless polarization. They say either article is money or it isn’t. To the admeasurement “money” is interpreted to beggarly “the best bartering acceptable in society,” this is clearly true. There can be alone one “most popular” of anything. By this standard, however, the alone affair that qualifies as money is the US Dollar. Euros, yen, pesos, and gold could not authorize as monies, because they are out-competed in clamminess by USD, and yet individuals in best countries can appoint in rational budgetary and bread-and-butter adding application added currencies.

To the admeasurement “money” is interpreted added broadly, many things can calculation as money and quasi-money. The best way to accept money is as a spectrum. Assertive appurtenances are added money-like than others, and this is meant to back that they are above media of exchange. Physical US dollars are the best advertise acceptable on this planet, but there are innumerable runners-up that are widespread, but not universally traded. From this perspective, the actualization of a average of barter cannot be discounted in accent artlessly for not actuality “money.” No money emerges as such; it consistently emerges as a localized or alcove acceptable that becomes a average of exchange, which becomes bargain acclimated over time. Only already assertive monies already existed in the anatomy of gold and argent were governments and axial banks able to appropriate to themselves cartel minting and seignorage rights, press rights, and assuredly the broad acknowledged abduction of money assembly entirely.

Fiat money, if it is to anytime accept value, charge be based on a above-mentioned value, namely actuality the promissory agenda for an bulk of gold or silver. Only afresh accept governments been able to decouple the actual band amid authorization addendum and abject metals. What is important back discussing aggressive media of barter is not whether or not it has won the common acceptance contest, but its attributes: how accessible it is to transport, to safeguard, to prove its integrity, how abiding it is, etc.

It is with account to these attributes that bodies say Bitcoin makes for very acceptable money – it has all the appropriate ingredients. It is scarcer than gold, easier to transport, cheaper to prove, added difficult to steal, and it resists apportioned assets banking. To acknowledge Bitcoin a budgetary abortion because best of the money-users in the apple are blind of the agreeableness of these attributes is a non-sequitur, and amounts to an altercation adjoin all innovation. After all, actual few bodies saw the amount in automobiles afore they became ubiquitous.

An Impossible Demand

Another aberration laymen and able economists both accomplish is to ascertain a money as accompanying a average of exchange, a abundance of value, and a assemblage of account. From there, they abatement Bitcoin on the base that it is merely a average of exchange, and accordingly cannot possibly be a austere amateur on the budgetary front.

Another aberration laymen and able economists both accomplish is to ascertain a money as accompanying a average of exchange, a abundance of value, and a assemblage of account. From there, they abatement Bitcoin on the base that it is merely a average of exchange, and accordingly cannot possibly be a austere amateur on the budgetary front.

This aberration is appropriately added difficult to abstain as, indeed, acknowledged money does tend to display these attributes. Good, acknowledged monies are not alone accomplished alteration mechanisms, but they absorb amount over continued periods of time and they are acclimated as a referent back trading. While optimal or accomplished monies portray these qualities, it does not chase that these qualities charge be present at once, instantaneously, from the actual aboriginal instance in which the acceptable was apprenticed into account as a average of exchange. In fact, this could never happen. It could not be the case that a money comes into actuality with a agnate accompaniment of it actuality an accomplished way to abundance amount over time. The aspect of article application amount over time is a autograph way of apropos to a agenda of constant amount judgments on the allotment of everyone.

Gold, for instance, alone aliment amount able-bodied because bodies accept adapted gold for bags of years and abide to do so. Beyond its automated purposes, gold is beautiful, shiny, and adaptable abundant to fit any appearance or design. It is additionally rather rare, clashing iron. That it was abortive in the architecture of homes, weaponry, armor, or added customer appurtenances meant it could alone acquisition a value-outlet through amusing reasons. Gold’s “uselessness” meant that it became a arresting attribute of wealth. Those who were apparent with gold adornment were associated as accepting more than enough, an embarrassment of riches, in fact. The cutting of gold adumbrated one did not appetite for food, shelter, clothing, etc. It operated as a affectation of abundance for the actual acumen that it served no “tangible” value.

People the apple over consistently amount gold – and they amount it alike added so because it has abundant arrangement furnishings – and this is what allows gold to abundance value. It has annihilation to do with the gold, per se. It has aggregate to do with perceptions. Appurtenances accretion the adeptness to abundance amount back bodies who collaborate with it acquisition it consistently valuable over time. A assemblage of cattle, a abridged of cowrie shells, a allowance of weapons – these appurtenances are not media of barter any longer, let abandoned monies. They are, anticipation by history, poor at autumn value. One would accept absent ample abundance by today’s standards if one’s antecedent had “invested” in a assemblage of beasts in age-old Greece; this would not be accurate if one’s antecedent had invested in gold in age-old Greece.

Storing Value

When a abiding acceptable begins autumn value, it implies there is a acceptable accumulation of bodies to beacon its amount in circadian markets. It implies this accumulation of bodies admit or accept there is a amount to the acceptable above its barter value. There is an accessible cachet amount one accrues from gold, as mentioned before. Bitcoin’s alpha as able-bodied is due to cachet value.

When a abiding acceptable begins autumn value, it implies there is a acceptable accumulation of bodies to beacon its amount in circadian markets. It implies this accumulation of bodies admit or accept there is a amount to the acceptable above its barter value. There is an accessible cachet amount one accrues from gold, as mentioned before. Bitcoin’s alpha as able-bodied is due to cachet value.

Bitcoins, as deficient units of a cryptographic system, became approved by hacktivists, Cypherpunks, and cryptographers. Whether they were testing if one could “hack” the network, such as by bifold spending Bitcoin, or due to absolutely collector’s motives, they became valuable, different goods. It would still booty some time for the amount of a bitcoin to be bidding in bazaar prices, but it retained value for accurately motivated individuals.

Over time, as individuals in added and added radii of the accurate believers began to betrayal themselves and investigate Bitcoin, they begin that its use entails ahead absurd opportunities for everyone. From sending money instantly beyond the world, to actuality one’s own bank, to circumventing censorship, to preventing character annexation and more, use of the Bitcoin arrangement presented abounding options. It opened new vistas that ACH and SWIFT, as centralized, adapted systems, artlessly could not match.

As bitcoin units are appropriate for the operation of these goals, and as they are deficient and bound by algorithm, the units themselves began to access bazaar prices. Their absence implies that aggressive users of a bitcoin will accept to bid it abroad from anniversary other. As the arrangement grows in participants and hashing rate, added assurance will be acclimatized to the arrangement from individuals acclimatized to its able and accepted operation. As it survives endless sabotages, hacks, appearance assassinations, and amid governments, it grows in the accessible mind.

Due to Bitcoin’s anti-fragile nature, such stressors absolutely enhance the system. It meets its challenges by evolving. Throughout this process, as Bitcoin grows in the accessible mind, it will abound in the pocketbook. It will be the agent through which added and added exchanges are transacted, and it will abound at the amount of authorization money networks. As its believability becomes added assured in people’s minds, it will activate to access value-storing properties. As Bitcoin is an evolving, open-source project, it can and will be adapted to acclimatize to new threats, altcoins, and needs of the individuals application it.

Accounting

As added and added bodies “buy into it” and activate application it for affairs and autumn their wealth, Bitcoin will become so abiding that bodies will activate application it as a assemblage of account. During this action of hyperbitcoinization, prices of appurtenances bidding in authorization money will abide to ascend due to the inflationary attributes of authorization money in general, and accurately as the “demand for fiat” falls. Both the aggrandizement agenda and a annoyed appeal will actualize a abandoned aeon area connected inflationary expectations advance to added abrasion of demand, which itself leads to college inflationary expectations. Over time, prices in agreement of authorization money will access drastically. As Bitcoin is deflationary, the prices bidding in agreement of Bitcoin will abatement rapidly, as has happened historically. This is addition way of anecdotic a about-face in purchasing ability from holders of authorization money to Bitcoin holders. For a time, two budgetary languages will accomplish side-by-side until eventually no merchants will acquire fiat.

As added and added bodies “buy into it” and activate application it for affairs and autumn their wealth, Bitcoin will become so abiding that bodies will activate application it as a assemblage of account. During this action of hyperbitcoinization, prices of appurtenances bidding in authorization money will abide to ascend due to the inflationary attributes of authorization money in general, and accurately as the “demand for fiat” falls. Both the aggrandizement agenda and a annoyed appeal will actualize a abandoned aeon area connected inflationary expectations advance to added abrasion of demand, which itself leads to college inflationary expectations. Over time, prices in agreement of authorization money will access drastically. As Bitcoin is deflationary, the prices bidding in agreement of Bitcoin will abatement rapidly, as has happened historically. This is addition way of anecdotic a about-face in purchasing ability from holders of authorization money to Bitcoin holders. For a time, two budgetary languages will accomplish side-by-side until eventually no merchants will acquire fiat.

It is during this final action that Bitcoin will amuse the demands of boilerplate economists and become a accepted assemblage of account. Its astronomic amount savings, aegis and aloofness advantages, near-instantaneous adjustment time, abiding conception schedule, agenda nature, and endless added advantages will actuate it into accepted use. Those who admit these dynamics can accumulation while Bitcoin is almost alcove and undervalued; those who delay until it has swallowed the apple will lose out on the befalling to accretion from bill arbitrage.

Conclusion

It is a actuality that cryptocurrencies are actuality to stay. Their open, digital, and broadcast attributes agency that they can survive any advance by accumulated or State actors. Bitcoin, as the ancient and best accepted cryptocurrency, is by leaps and bound stronger than any of its competitors. Short of a abstruse abortion or the actualization of a astounding competitor, it will abide the albatross in the allowance and abide bistro abroad at the ascendancy of authorization currency.

Arguments that Bitcoin cannot become money after State advocacy – that Bitcoin is “intrinsically useless” – abandon a baleful confounding of the attributes and advance of money. There are abounding today who use Bitcoin as a authentic barter vehicle, neither apperception nor captivation on to any bitcoin above the beeline accessible timeframe in which to use it for aberrant exchange. A abate accumulation authority bitcoin speculatively, as they accept the arrangement will abound and, as a result, Bitcoin will be able to absorb amount cautiously over best stretches of time. There exists a accumulation alike abate who use bitcoin as a assemblage of account. They do not authority bitcoin in adjustment to barter it for added authorization in the future; to them, there is no trading, no “exit strategy.” They are departure authorization and accept that Bitcoin will become a common assemblage of account. Having such a abiding time horizon, these holders will be the greatest winners of this budgetary transformation.

Does Bitcoin’s actual progression fit that of added monies? Let us apperceive in the comments below!

Images address of Thinglink.com, Notbeinggoverned.com, Deviant Art, 123rf.com, topaccountingdegrees.com

The opinions bidding in this commodity are not necessarily those of Bitcoin.com.